Amit Paranjape, a regular contributor and primary adviser to PuneTech, had earlier written an article giving an overview of Supply Chain Management, and companies in Pune that develop software products in this area. This article, the next in the series, goes into details of the problems that SCM software products need to tackle in a consumer goods supply chain. This is a longer-than-usual article, hence posted on a Friday so you can read it over the weekend (assuming you are not attending one of the various tech activities happening in Pune this weekend.)

Here is a story about a packet of ‘Star Glucose Biscuits’ in ‘SuperMart’ on FC Road in Pune, told from the point of view of Supply Chain Management. Buckle up your seat belts because this story has tension, drama, emotion, and suspense (will the biscuits reach the shops in time for the T20 World Cup Promotion?)

Overview

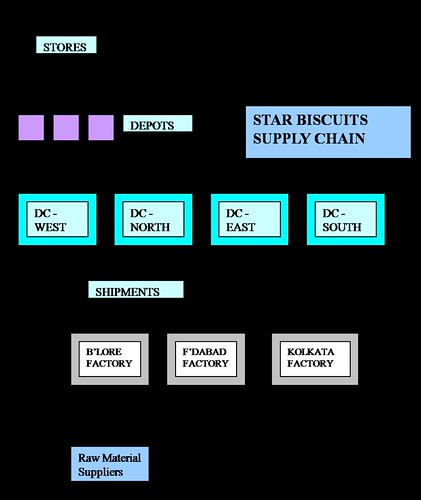

The story begins at the Star Biscuits Factory in Bangalore where flour, sugar and other raw material are converted to the finished cases of biscuits. From Bangalore, the biscuits are shipped to a regional Distribution Center on the outskirts of Pune. This center then ships the biscuits to the local depots in different parts of cities such as Mumbai, Pune and from there they ultimately end up at the neighboring retail store, such as SuperMart on FC Road, Pune. In this seemingly simple journey are hidden a host of difficult business decisions and issues that arise on a daily basis. And to complicate matters further, we will throw in a few ‘interesting’ challenges as well! Throughout this story, we will take a deeper look at how the various business processes, and software programs associated with planning this entire supply chain network work in concert to bring you the extra energy and extra confidence of Star Glucose Biscuits.

This chain, from the raw materials all the way to the finished product sitting on the retail shelves is called the supply chain, and managing it efficiently is called supply chain management. Supply chain management is one of the most important aspects of running a manufacturing business, and doing it well has been the key to the phenomenal success of such giants as Walmart and Dell. The basic conflict that SCM is trying to tackle is this: you must have the right quantity of goods at the right place at the right time. Too few biscuits in the store on Sunday, and you lose money because have to turn customers away. Too many biscuits in the store and you have excess inventory. This is bad in a number of ways: 1. It eats up shelf space in the store, or storage space in your warehouse. Both of these cost money. 2. Your money, your working capital is tied up in excess inventory which is sitting uselessly in the warehouse. 3. If the biscuits remain unsold, you lose a lot of money. The same trade-off is repeated with intermediate goods at each step of the supply chain.

The Supply Chain in detail

At the Star Biscuit factory in Bangalore, they are gearing up to meet forecasted production requirements that were recently communicated by the Star Biscuits headquarters (HQ) in Mumbai. This is the ‘demand’ placed on this factory. These production requirements consist of weekly quantities spread over next 12 weeks. The factory planning manager now has to plan his factory to meet these requirements on time.

Let us see what all he needs to take into account. First, he needs to figure out the raw material requirements – wheat flour, oil, sugar, flavors, etc. as well as packaging material. Each of them has different procurement lead-times and alternative suppliers. He needs to pick the time to place orders with the right suppliers so that the material is available on time for the manufacturing process.

The manufacturing process itself consists of two primary steps – making the biscuits from the flour, and packaging the biscuits into individual boxes and cases. Typically, multiple parallel making and packing lines work together to achieve the desired output. The packing process scheduling is often complicated further by a series of different sizes and packaging configurations.

Ensuring that the right amount of material is available at the right time is called Material Requirements Planning (MRP), and in the old days, that was good enough. However, this can no longer be done purely in isolation. Even if the amounts of the different raw materials required are predicted precisely, it can be problematic if the various making and packing machines do not have the capacity to handle the load of processing the raw materials. Hence, another activity, called capacity planning, needs to be undertaken, and the capacity plan needs to be synchronized with the materials requirement plan, otherwise excess raw material inventory will result, due to sub-optimal loading of the machines and excessive early procurement of raw material. Excess inventory translates to excess working capital cash requirement; which in the current hyper competitive world is not good! Luckily, today there are sophisticated APS (Advanced Planning & Scheduling) software tools that are far superior to traditional MRP systems that enable him to simultaneously do material and capacity planning.

Happy with the production plan for the next 12 weeks, the factory planner then makes sure that individual making and packing lines have their detailed production schedules for the next two weeks. The finished cases leave his factory on truck loads. But where do they go from here? The journey to SuperMart where our customer wants to purchase the final product is still far from over!

The next stop is a big distribution center (DC) for the western region that sits on the outskirts of Pune. This distribution center is housed in a large warehouse with multi-level stacking pallets (each pallet contains multiple cases) of multiple different products from the manufacturer. A set of conveyors and fork-lifts enable material to flow smoothly from inbound truck docks to stocking area, and from the stocking area, to the outbound truck docks. These products come not only from our Star Biscuits factory in Bangalore, but from various other Star Biscuits factories located all over India. In fact, some of these products could also be directly imported from the parent company of Star Biscuits in the UK (the ones with the bitter, dark chocolate!). This Pune distribution center stocks and stores this material in proximity to the western region – with specific emphasis on the large Greater Mumbai and Pune markets. How are all these warehousing related activities smoothly managed? The DC manager takes full advantage of a Warehouse Management System Software (WMS). The truck loading and load containerization is managed by a Transportation Management Module.

From here outbound shipments are sent to smaller regional depots that are located in the cities, nearer to the stores. From these depots, the biscuits are finally shipped to the stores to meet the end customer demand. How is this demand calculated? Clearly, it is impossible to predict the demands coming from individual customers at the store, few weeks in advance! Hence it is necessary to ‘forecast’ the demand.

Forecasting demand and determining stock levels

Who decides how much material to stock? And how is it calculated? Clearly, as we briefly indicated earlier, keeping too much product is costly and keeping too little results in stockouts (material unavailability on store shelf) at the stores, thereby resulting in unhappy customers and lost sales. Too much product equals excess working capital (similar to the excess raw material problem) and is not good for the company’s financial performance. Too little, and we will run out if there are any major demand swings (commonly referred to as ‘demand variability’). To achieve the optimum level of the desired stock on hand to buffer against demand variability a ‘safety stock quantity’ is maintained in the warehouse. This quantity is computed by the central Supply Chain Management (SCM) team at HQ.

The actual computation of the safety stock for different products in the distribution center is calculated using a statistical computation (In some cases, a manual override is also done over the computed value). The most common technique consists of using Poisson distribution, demand & supply variability historical data, demand & supply lead time data, and desired customer service levels. Customer service levels are assigned based on an “ABC” classification of the products. ‘A’ category items are the fast movers and have a high revenue share and are typically assigned a 99% customer service level. Roughly speaking, a ‘99%’ customer service level implies that the safety stock quantity is adequate to guard against demand variability signals 99 times out of 100. Proactive planning on a daily basis that involves daily monitoring of stocks of all products is done, based on actual outbound shipments, can many times help in even reacting to that ‘1 in 100’ cases with rapid corrective measures.

The forecasting process for all the products is done at Star Biscuits Head Quarters. Let us continue with our example of ‘Star Glucose Biscuits’. The modern forecasting process is more accurately referred to as a ‘Demand Planning’ process. Statistical forecast is one input to the overall process. Statistical forecasts are derived from shipment history data and other input measures such as seasonality, competitor data, macro-economic data, etc. Various statistical algorithms are used to come up with a technique that reduces the forecasting error. Forecasting error is typically measured in ‘MAPE’ (Mean Absolute Percentage Error) or ‘MAD’ (Mean Absolute Deviation).

The statistical forecast is then compared with the sales forecast and the manufacturing forecast in a consensus planning process. This is often done as part of a wider ‘Sales & Operations Planning Process’ in many companies. Often times, a ‘top-down’ and ‘bottom-up’ forecasting technique is used. Here, individual forecasts at the product level are aggregated up the product hierarchy into product group forecasts. Similarly, aggregate product group level forecasts are disaggregated down the same hierarchy to the individual product level. These are then compared and contrasted and the expert demand planner then takes the final decision. Aggregated forecasting is important, since often times this reduces the forecast error. In case of Star Glucose Biscuits, the aggregated product hierarchy would first combine all sizes (e.g. 100 gm, 200 gm), then aggregate along sugar based biscuits type, and then into ‘All biscuits’ groups.

The end result of the demand planning process is the final consensus forecast that is calculated in weekly time intervals (commonly referred to in planning terminology as ‘buckets’) for a time horizon of 8-12 months. The demand forecasts drive the entire Star Biscuits Supply Chain. To simplify the overall Demand Planning process, modern DP software tools provide great help in statistical forecasting, OLAP based aggregation/disaggregation, and in facilitating interactive collaborative web-based workflows across different sets of users.

Managing the Supply Chain

It was easy if all we had was one DC in Pune and one factory in Bangalore, supplying to one store. But Star Biscuits has a much more extensive network! They have multiple factories throughout India and the same biscuits can be produced by each factory. How much of the demand to allocate to which factory? This problem is addressed by the Supply Chain Management (SCM) team that works in close concert with the Demand Planning team. The allocation is made based on various criteria such as shipment times, capacities, costs, etc. In coming up with the sourcing, transportation and procurement decisions – minimizing costs and maximizing customer service are amongst the top business objectives.

Now, getting back to Star Biscuits, they have over 300 products across 5 factories and 4 DCs. The DCs in turn, receive demand from nearly 100 depots that are supplying to thousands of stores all over India. Determining the optimal allocation of demands to factories, safety stocks to DCs and all the transportation requirements is beyond the abilities of humans. Such a complicated scale and decision problem needs computer help! Luckily, advanced SCM software tools can help the SCM team make these decisions fairly efficiently. Good SCM tools allow user interactivity, optimization, and support for business specific rules & heuristics. The SCM process thus determines the 12 week demand in weekly buckets for our factory in Bangalore, where we started.

To summarize, the overall supply chain – we saw how the product demand gets forecasted at HQ by the demand planning group. The SCM group then decides on how to allocate and source this demand across the different factories. They also decide on the ideal safety stock levels at the DCs. The WMS group ensures the efficient management of the distribution center activities. The factory planner team decides on the most efficient way to produce the biscuits demand allocated to their plant. The transportation management team is assigned the task of shipping material across this network in the best possible way to reduce cost and cut down on delivery times.

Dealing with drastic changes

And all of this is just to do “normal” business in “normal” times.

All the processes described earlier are great if the business works at a stable, reasonably predictable pace. Our safety stock policies guard against the day to day variability. But what about drastic changes? Unfortunately in the current environment, the only thing that is constant is ‘change’.

Here is what happened at Star Biscuits. One day, out of the blue, the entire planning team was thrown into a mad scramble by a new request from the marketing department. In order to react to a marketing campaign launched by one of their top competitors, the marketing department had a launched a new cricket promotion of its own for the next month.

Promotions are extremely important in the consumer goods industry. They entail targeted customer incentives, advertising spending and custom packaging – all in a synchronized fashion. The success of promotions often times make or break the annual year performance of a Consumer Goods Company. Promotions driven sales often times contribute large double digit percentage of total sales of consumer goods companies.

This particular cricket promotion involved a special packing requirement with the star logos on the packet. The target customer demand was not only upped by 50%, the offer also had a ‘Buy 1 Get 1 Free’ incentive. As a result, the total demand was going up by nearly 300%.

The SVP in charge of Supply Chain was trying his best to get a handle of the problem. He was getting irritated by the constant pressure he was under from the SVP Marketing, and the CEO.

The demand planning team had to quickly alter its demand numbers to meet the new targets. The real trouble spot was brewing at the SCM team. The team had to rapidly make decisions on where to source this sudden demand spike. While cost optimization is important, meeting customer demand at ‘all costs’ is the key. The Bangalore factory was already running at 90% capacity and was in no position to produce much more. Luckily for the SCM team, their SCM tool quickly ran a series of scenarios and presented possible alternatives. These scenarios looked at various alternatives such as contract packing, new factories, expedited raw material shipments, direct shipments from the factories to the stores, etc. One of the resulting scenarios seemed to fit the bill. It was decided that bulk of the extra demand be routed to the alternative factory in Faridabad which had some spare capacity. From here, the product was going to be shipped directly (where feasible) to the Mumbai and Pune depots, where a large chunk of the promotion driven demand was expected. The rest of the country’s demand was going to be met by the conventional approach, from the Bangalore factory. The new package also resulted in demand for new packaging material with the cricket logos. New scenarios were generated that source this material from packaging material suppliers from the middle-east. (Interesting to note, that in some time crunched promotions, packaging material often times ends up being the bottle neck!)

Satisfied with this approach, the SVP Supply Chain ordered his team to come up with process improvements to prevent such scrambles in future. Luckily there was an easy solution. The Demand Planning software tool had a nice capability to support an integrated promotions planning & demand planning workflow. Such workflows look at various promotions related data, such as timing, costs, volume, competitor strategies and efficiently plan future promotions – instead of reacting to them at the last minute. In turn, such effective promotion planning can not only drive revenues, but also further improve supply chain efficiencies.

The SVP is happy, but what happened to our end customer on FC Road Pune? Well, she walked away happy with her promotion pack of Star Glucose biscuits, completely oblivious of what had happened behind the scenes!

About the Author – Amit Paranjape

Amit Paranjape is one of the driving forces behind PuneTech. He has been in the supply chain management area for over 12 years, most of it with i2 in Dallas, USA. He has extensive leadership experience across Product Management/Marketing, Strategy, Business Development, Solutions Development, Consulting and Outsourcing. He now lives in Pune and is an independent consultant providing consulting and advisory services for early stage software ventures. Amit’s interest in other fields is varied and vast, including General Knowledge Trivia, Medical Sciences, History & Geo-Politics, Economics & Financial Markets, Cricket.

Amit Paranjape is one of the driving forces behind PuneTech. He has been in the supply chain management area for over 12 years, most of it with i2 in Dallas, USA. He has extensive leadership experience across Product Management/Marketing, Strategy, Business Development, Solutions Development, Consulting and Outsourcing. He now lives in Pune and is an independent consultant providing consulting and advisory services for early stage software ventures. Amit’s interest in other fields is varied and vast, including General Knowledge Trivia, Medical Sciences, History & Geo-Politics, Economics & Financial Markets, Cricket.

Hi Amit,

Simple but detailed coverage of all SCM activities and decision making points. Thanks for this.

Regards

Shriram, Thanks for your feedback. Amit

Amit – an excellent article and explanation of the process. Companies can realize tremendous value by having accurate data in a timely manner. In this very difficult economic environment understanding demand and the resulting effect on various dependant processes should be the number one focus for every manufacturer and retailer worldwide.

AmitP, nice one. Introducing the bullwhip effect will get readers more insight into supply chains, and why dynamic complexity is different from, and often much more complex than, detail complexity.

Regards,

Srini

Andy, Srini: Thanks for your comments.

Srini – Good suggestion regarding the ‘Bullwhip Effect’. Might write something about it in future.

thanks

Amit

Very interesting article and a good read.

My understanding so far is SCM (based on OR) deals with “items” that are essentially identical or similar. But, what if the items are not identical? Are there good heuristics to “predict” demand when the items are not identical?

Tushar, Thanks for the feedback. There are some techniques to forecast demand based on related or dependent items. Also, on the ‘supply’ side, you could encounter items are not identical in many cases. In some industries, for example, you could run into each item being unique (Order Specific Bill-Of-Materials).

Amit

Tushar,

As Amit has mentioned, it is assumed that pattern of demand for a particular group of items has similar characteristics. Based on such clusters initially the forecast is generated. After a few periods, anyway you have historical data created for further forecast.

Lesson learnt. This biscuit business is a risk. Too much of supply chain. One should sell icecream.

Nice article Amit.

Excellent article Amit.

Thanks Amit and Shriram for your response. Are there any references to these demand forecasting techniques for a layman? My background is in CS.

Deepak, Bhaskar:

Thanks for your feedback.

Amit

Tushar,

I will try to dig something specific for you; but unfortunately not too many specific references out there. You can find a good detailed discussion on the various forecasting techniques in any good statistics book. However, the application of these techniques to solve real-world forecasting problems is partially a science, and partially an art – that Demand Management Software Companies and Consultants have built over the years. Hence these best practices are often not seen published in the public domain.

If any of the readers are aware of any good reference point in the public domain, please post them here.

thanks

Amit

Thanks Amit. It would be good if you can provide some terms to do a google search on and hopefully I’;ll hit some blog/website which describes a few things.

Hi Tushar,

Just check this, may not be sufficient but something to start with http://www.forecastingprinciples.com/

You may also like to sign up and read my organisation’s white papers related to Forecasting here http://www.sas.com/technologies/analytics/forecasting/index.html#section=6

Do let me know your feedback.

Thanks Shriram for the links. I’ll definitely check them out and let you know.

Interesting article Amit, it is a scenario which many of the planning/manufacturing personnel face on a somewhat regular basis.This scenario is almost a simulated scenario for NPI (New Product Introduction) to market.

A few things which I would like to add (from experience).

Process Improvements and lead time reduction should not be a “reactive” response. It has to be proactive response. Process improvements have to be on a perpetual basis, one of the fruits of which is “lead time reduction”.The forecasting and planning department has to be in loop with these improvements . Many a times the “real” capacity gets buffered by safety nets and a “reduced” capacity value is presented to the forecasting people.

The spikes that are experienced can be documented and the “Maximum Capacity” can be calculated getting the “weighted mean average” depending on the “lead time contract” the manufacturing facility has with its warehouse.Incentive pay should be given to the personnel for meeting the “lead time expectations”.

Now the first step is setting up a realistic “lead time contract” with the warehouse which sets up the expectations on the manufacturing facility to deliver. The extra capacity can be in the form of labour, additional machine that can be partly used , different machines that can be st up to do the job etc.So it has to be extra and not excess capacity because if you have excess capacity then the facility is not going to be economically viable.This helps the facility to adapt to these demands set on it.

Also the “marketing demands/forecasts” have to be realistic and timely (or is that a pipe dream). Because simply put even if you have the best software , personnel and equipment available , time is one dimension that cannot be manipulated (tamed) beyond reason and comes at a great cost.

I, Rohit Banthia, student of MBA, IIBR colege-pune.

This article helps me to understand properly about supply chain management, with example.

Hi Amit, Do you have something on Supply chain model in retail chain following retail franchisee & wholesale business models.

Another aspect of effective supply chain management occurs in the distribution center. Employees must be able to upload and offload shipments quickly and safely. Truck loading platforms specifically designed to provide a safe environment can positively impact the process and take less time.